Quick Reference Guide

to Supplemental Health Insurance

Ready for a crash course in supplemental group health insurance? Find the terms you need along with background on why you need them. This supplemental guidebook will help you get in-the know so that you can help your clients find the right type of supplemental solutions to meet their needs.

Supplemental Health Insurance

Let’s start with the basics.

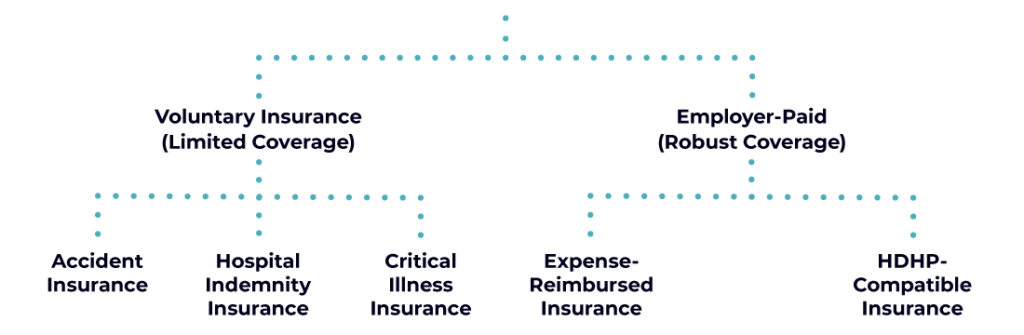

At the mention of group supplemental insurance, most employers immediately think of standard benefits like life, short-term disability and long-term disability. If you add in “health”—such as group supplemental health insurance—they’ll likely think of worksite voluntary plans, such as accident, critical illness and hospital indemnity. These are health insurance products that employees may choose to purchase through their companies at lower rates than they could get on their own.

But there’s another category of supplemental health insurance you may not know about: employer-sponsored supplemental. It’s designed to help pay for those out-of-pocket expenses that a primary medical insurance plan doesn’t cover. Employer sponsored supplemental health insurance is unique because it’s built with the expectation that employees will use the benefits, and that the employer wants to offer benefits with the coverage they need. It’s additional financial protection for medical costs, and, given the strong connection between financial well-being and health, it’s something more employers are offering than ever before.

In this guide we will take a closer look at the different types of supplemental health insurance and the advantages and disadvantages of each.

Supplemental Health Insurance

Voluntary Health Insurance

Voluntary insurance, also known as a worksite voluntary plan, is a type of supplemental insurance that employees can elect. They’re generally employee-funded, though the employer may choose to contribute as well. Common voluntary insurance plans are hospital indemnity, critical illness and cancer policies. These insurance plans typically offer protection in one of two ways:

Provide a lump sum that can be used for health expenses, mortgages, childcare or other financial expenses in times of illness item

Offer an inpatient/outpatient benefit maximum that can only be applied to specific types of expenses, such as outpatient surgery or in-hospital stays.

An employer may purchase these supplemental plans for their employees, but most offer them on a voluntary basis. This means the employee can elect to purchase coverage but isn’t required to do so.

People often use the words “supplemental” and “voluntary” interchangeably, but they aren’t the same.

Accident insurance helps provide additional funds that may not be covered by a medical insurance plan in the event of an accident. Funds are only provided if the event meets the defined terms for an “accident” in the insurance policy. The money can be used for emergency treatment, imaging diagnostics, over-the counter medications, physical therapy, childcare and other expenses incurred from the accidental injury.

Critical illness insurance plans help provide funds for medical expenses in the event of a disease or condition specified in the scope of coverage. This may include cancer, heart attack or stroke. A diagnosis, pathology report, or evidence of hospital admission may be required to receive a lump sum payment.

Depending on the insurance plan, hospital indemnity insurance may provide a fixed amount per day, week or month. Coverage may be triggered when specific events associated with hospital visits occur. A typical insurance plan may cover hospital admission, inpatient rehabilitation or hospital stays. Some insurance plans may even cover outpatient surgery.

Employer-paid supplemental health insurance

There are two types of employer-paid supplemental plans: expense reimbursed insurance (also referred to as medical reimbursement insurance plans) and HDHP-compatible plans. Both types can be sponsored by the employer. Unlike employer-paid primary medical plans, supplemental insurance plans can be offered to specific employee classes only as they are excepted benefits (benefits not subject to ACA nondiscrimination rules). Let’s take a closer look at the types of coverage within these two types of employer-paid supplemental plans.

Expense reimbursed insurance pays employees for their actual out-of-pocket healthcare expenses, according to the specified policy limits. Expense reimbursed insurance plans can cover deductibles and coinsurance, as well as other out-of-pocket expenses for everyday healthcare expenses like maintenance prescriptions, doctor visits, labs and other diagnostics. Because these plans are based on broad categories of coverage, they have a lot of flexibility. Some even offer coverage for 213(d) expenses, which aren’t usually covered by primary medical insurance plans. 213(d) expenses are those the IRS determines are tax deductible medical expenses in section 213(d) of the tax code (same expenses that are allowed in FSAs and HSAs). Examples of 213(d) expenses include LASIK, brand name prescriptions, Executive Physicals as well as dental and vision expenses. The maximums are based on total reimbursement limits per plan year.

These are employer-paid supplemental plans that pay on a fixed schedule of payments for specific eligible services. Payments are typically based on a per day amount (depending on coverage levels) for a set maximum number of days per plan year. These supplemental plans deliver what HSAs and voluntary plans can’t: the extra protection of insurance with coverage for routine and unexpected medical expenses, with benefits available from day 1. Plus, they can be offered to all employees or select group(s) of employees and any enrollment tier; there is no need to match primary healthcare plan enrollment.

Voluntary vs. employer-paid

Key difference #1

Types of Coverage

Although each insurance policy’s conditions are different, in general, worksite voluntary plans only offer coverage when narrow conditions are met. If a specific event (such as a hospital stay or specified disease onset) doesn’t happen, there is no coverage. Example: a cancer insurance policy would not cover any expenses for treating a heart attack.

Unlike voluntary insurance, employer-paid supplemental health insurance plans aren’t tied to a specific type of condition or event to trigger coverage. Instead, these plans are built to cover routine expenses like doctor visits, lab work, maintenance prescriptions and physical therapy. But in the event of an unexpected hospitalization or cancer treatment, employer-paid supplemental plans are also there for financial support.

Why does it matter?

While a voluntary plan may provide coverage for unexpected hospitalizations or diseases, it may not cover routine prescription co-pays or a doctor’s visit. These coverage voids result in higher out-of-pocket expenses, especially considering primary plan deductibles and the prescription coverage within those deductibles.

Many employees don’t realize that their voluntary insurance plans are limited to a condition or event. They may expect full coverage for voids in primary plans after enrolling in (and paying for) voluntary insurance plans. Sadly, many end up surprised, frustrated and faced with large financial burdens if their out-of-pocket health expenses don’t fit the plan’s conditions.

Key difference #2

Strategic Tool

Who pays for the coverage is another important difference between these two categories of supplemental insurance. Worksite voluntary insurance is typically paid for by the employee. Voluntary plans are made available to all employees, but the employees ultimately choose whether to participate in and pay for the benefit.

On the other hand, employer-paid supplemental plans are a way for companies to invest in their talent by providing more valuable insured coverage. With these plans, employers define enrollment based on title, tenure or performance. This empowers the employer with a new level of flexibility and control to create a benefits structure that aligns with their cost and talent management objectives. With these plans, employers can the right balance between controlling benefit costs and recruiting and retaining talent.

Why does it matter?

“Improving” a benefits package with a voluntary benefit that employees must pay for isn’t an improvement. Employees don’t see these kinds of additions an investment into employees’ health and well-being, and it may even detract from the company’s talent management success.

With today’s fiercely competitive talent market, companies need a more holistic approach to talent management. Recruitment, compensation and benefits are no longer standalone elements—they’re one complete package. The right employer-paid supplemental plans can help employers balance cost and coverage as it enables employers to give more than a comparable investment in compensation.

an innovative approach to boosting benefits

With what you’ve learned in this quick reference guide, you’re now equipped with the vocabulary and knowledge to introduce the different types of supplemental health insurance options to your clients. You can explain the similarities and differences and, ultimately, help your clients select supplemental health insurance that will help them meet their goals.

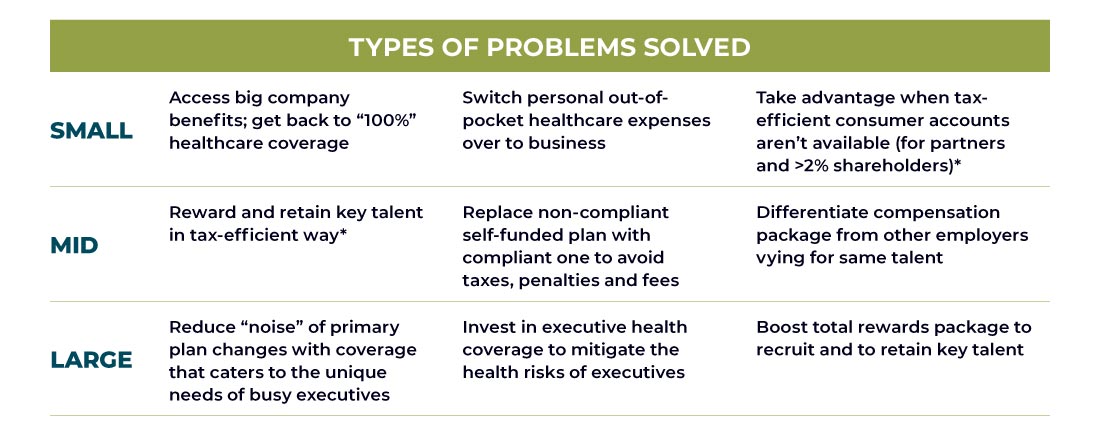

Employer-paid supplemental health insurance plans can solve multiple problems for employers of all sizes. Here are a few examples:

Your Next Steps to Tailored Solutions Awaits

Whether you’re ready to chat with us or simply want a quick quote, we’ve got you covered. Schedule a call to discuss your needs or fill out our quick RFP form for a personalized proposal—it’s your choice!

Let’s Chat

Schedule a quick, no-obligation call with one of our ArmadaCare experts to uncover how supplemental health insurance can help you tackle workforce challenges, and stand out as a benefits solution leader.

Prefer a Detailed Proposal?

Skip the call and get straight to the details. Fill out our quick RFP form to receive a personalized quote tailored to your unique needs. It’s fast, easy, and puts you one step closer to the perfect solution.